In the world of real estate, there is so much real estate agents have to do and cover. One of the most important things they do is prepare a net sheet. It sounds like a simple task, but there are many nuances to it and mistakes can have significant consequences for you as a buyer.

Net Sheets are a confusing topic for many people, especially for first-time homebuyers. What is this document? How do I get one? Why does it matter to me? This article will help clear up some of the confusion and give you important tips on how to use your net sheets to improve your personal finances.

What is a Seller Net Sheet?

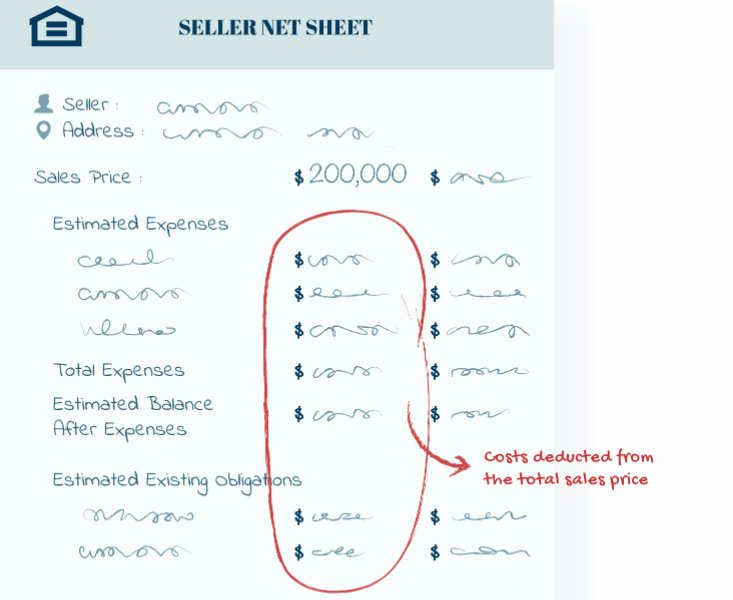

A net sheet is a document that lists the expenses paid for by you and your lender, as well as any gains/losses incurred on the sale of the property. It shows how much money you will receive from the sale to use towards paying off debts (e.g., mortgage payoff), closing costs, or reinvesting in another property.

This is also called “seller’s net” because it displays what amount of gain has been made during this particular transaction given all inputted data such as listing price and commissions paid out to agents involved with selling the house.

The typical seller’s net sheet includes columns that calculate: income; expense; taxes due at settlement date; funds available after settlement date for investment or debt reduction; and the difference between what was paid for sale (expenses) and the amount of money due at closing.

Why does my Seller Net Sheet matter?

It matters because this is your chance to create financial stability in your life. Your real estate agent should be helping you get information about your lender’s requirements, as well as all expenses that will come up once you buy a home.

In addition, they need to help with calculating how much it’ll cost to pay back loans after interest rates are applied. This way you can plan ahead on how many hours/monthly salary it would take from now until when the payoff date comes around before considering the purchase.

It also means you can estimate the value of your new home, and whether or not the purchase is actually worth it in terms of time, energy, and finances.

Seller’s net sheets have been around for a long time and are a key part of the process for homebuyers. They can be tedious to fill out, but they’re worth it in order to understand what your true financial situation will be like after buying a house.

How to read a seller's net sheet

The first section on a Seller Net Sheet looks like “Listing Price: $100,000″. The number in parentheses indicates what was paid for the property when it was purchased – “$0” means that there were no costs associated with purchasing the house.

This section lists all the expenses related to selling a home, such as commissions paid to agents and brokers. If an agent sold your house for $135,000 with only listing fees of $500 (which is common), then they would take home about $133,500 after commission.

Individuals who are in charge of paying off a mortgage from their personal account will also see their payoff amount listed under “Mortgage Payoff:”.

One important thing I want you to note is that there can be different columns labeled “Adjustments/Deductions” because this form has been customized. For example, some people might find it helpful to list things like property taxes and capital gains tax on column C while others might prefer to list them under “Adjustments/Deductions.”

Here are the numbers that appear on the sheet:

- Estimated sales price. This is the price the seller expects to get for the house. The price depends on many factors, such as the condition of the house and location. A successful real estate agent should help you come up with the right estimated price.

- Listing price. Agent listing price is the amount that was paid for a property when it was originally purchased – $0 means there are no costs associated with buying this home. The seller’s net sheet also includes closing costs in this section to help you understand your total profit or loss on selling this particular house.

- The estimated cost of sale. This is a list of all costs associated with selling the property and includes closing fees, commissions paid to agents or brokers, real estate taxes (principal only), and capital gains tax due at settlement.

- Adjustments/deductions. Any adjustments from previous transactions may appear in this column. For example, if you had made improvements on your home that were not reflected in its value before it was sold, then those expenses would show up here as well as any capital gains tax owed by the seller prior to settlement. If there are no adjustments listed in this section then the line will be left blank.

- Mortgage loan payoff. This is the amount of money the seller owes on their mortgage before they receive any proceeds from the sale. The buyer will be responsible for paying this amount at settlement.

- Net proceeds. This is a number that shows you your total profit or loss based on how much you paid for the home and what it sold for. The final column labeled “NET” will show this information in dollars, but some people prefer to see it expressed as a percentage. A good rule of thumb is between 40-60%. Anything below 30% return would make me want to think twice about selling my house because I wouldn’t be making very much.

- The “net proceeds” section of a seller’s net sheet can be calculated by subtracting the mortgage payment ($0) and adjustments (such as insurance premiums or property taxes that are not included in escrow) from the estimated sales price. The result represents what you would receive after selling your home if these expenses were paid for upfront rather than being split between buyer and seller during closing. As this is just an estimate on how much money will eventually come to you after all costs have been covered by buyers and sellers alike, it does not reflect your final net proceeds.

- Attorney fees. This is a list of all costs associated with selling the property and includes closing fees, commissions paid to agents or brokers, real estate taxes (principal only), and capital gains tax due at settlement.

- Grantor’s Tax. This is the sum of all taxes, fees, and costs charged to a seller when they sell their property for more than its original cost basis.

- Transfer Tax. This depends on whether it will be going through county or city channels. Transfer tax is paid by sellers at settlement in order to record the sale from one owner’s name into another’s. The charge varies depending on which state you are buying or selling real estate in because each has different rules about how much transfer tax needs to be paid as well as what type of properties are exempt from transfer tax; some states may even have no transfer taxes whatsoever (such as Alaska).

- Title Company Fee- Varies according to title company but most charges between $250 to $500. Title company means the company that will handle all the paperwork and closing costs necessary to finalize a real estate transaction.

- Appraisal Repair– Appraisals cost between $300-$400 for one appraisal report so you’ll need at least two reports for your property’s net worth calculation; these fees are paid by sellers before settlement because buyers will not want to buy a property without adequate knowledge about its value. In most cases, this fee may seem like an unnecessary expense but think again! Many buyers rely on appraisals to determine how much they are willing to pay for the property.

- Title Insurance- Independence title insurance varies according to the title company, but most charges between $400-$600. This is a one-time fee paid by sellers before settlement and it covers you in case something goes wrong with the transaction like a termite infestation that isn’t disclosed or any other issues with ownership of the property. Title insurance is required in all states except Alaska where it’s optional. It protects against someone else claiming ownership of the property after you’ve purchased it or refinanced on your loan with them. The buyer pays for this upfront at the time of purchase as well as any upfront costs associated with changing titles such as deed preparation fee(s). Taxes vary by state but can average about two percent per year and sometimes additional fees based on factors such as the home value amount being sold or transferred.”

- Recording fees – $160. Recording fees are paid by buyers to record a deed for the property with either county or city offices depending on what state you live in and they vary according to location and time of year.

- Realtor commission – Listing commission is the fee that a listing agent or broker charges for services as a real estate agent. The amount may vary widely depending on location and other factors, but generally, it is between two to three percent of the home’s selling price.

- Escrow fees – Escrow is a service provided by accounting professionals or organizations that ensure funds are transferred to the appropriate party at an agreed-upon time. The money in escrow is typically for real estate transactions, where it covers property taxes and other fees from one month’s date until another.

- Closing costs – Closing costs or actual closing figures are all those expenses associated with buying or selling the property where both parties must agree to transfer ownership in some way—usually through a sale contract (purchase), deed (sale) or land purchase agreement. A seller might offer closing cost assistance if they feel confident that their asking price will be acceptable; however, this would not be considered an incentive because there would still need to be acceptance by the buyer first at which point these amounts can become part of the negotiations process. Realtor commissions are not considered closing costs.

- HOA Packets and appraisal repairs – If an HOA requires monthly dues, the seller should pay for these up until closing. These are typically non-refundable; however, a seller might offer to contribute if they feel confident that their asking price will be acceptable and would not affect negotiations.

An example of a sellers net sheet looks like this:

- Sell price : $450,000

- Seller agent commission: – 3% $14,500

- Closing costs: – $17,000

- Seller’s net proceeds: -$350,000 (cash at closing)

Net Sheet Calculator For Sellers is a tool that will make it easier to calculate the amount of money you stand to lose or gain when selling your home. This article discusses how to use this free calculator and its features.

What is the importance of a seller's net sheet?

The main reason you need a seller’s net sheet is to record all real estate transactions you will be taking part in. The importance of a seller net sheet include:

- To record all transactions. A seller’s net sheet is important for recording all transactions. It is a breakdown of all the money that was collected from homeowners, real estate agents, and other parties involved in the property sale. The numbers on this document represent how much cash or check you received for your home at closing.

- A buyer will receive information about their loan balance according to what they are financing or purchasing such as mortgage payoff figures by subtracting an appraisal repair number.

- Title companies can use these figures to determine who should be paying any taxes associated with transfers between buyers and sellers related to transferring properties.

- On both sides of the table-the buyer side and seller side-real estate agents look out for themselves first which may cause them not to provide accurate figures during negotiations because it could mean less commission. Every real estate transaction must be recorded to get a perfect picture of the deal. It is all about being accountable for every cent.

- For accurate numbers. As a home seller, getting an accurate number is crucial because you need to know the estimated amount of your net proceeds. The totals contained in the documents allow you to make the right decisions.

- It builds confidence in the buyer. A well-organized seller’s net sheet estimates the total cost of the house, which shows the buyer its real worth. It helps build confidence in the buyer. It also helps the seller by giving a reliable estimate. Together with other documents, this sheet is essential for negotiating and closing the house. The buyer will not be able to close without it.

- A seller’s net sheet can help you stay organized. A seller’s net sheet is essential for staying organized. It can help you keep track of all the expenses and income related to your house sale. It also helps you stay on top of what needs to be done in order to sell your home such as getting repairs, new carpet, etc.

- A well-prepared seller has a better chance at making a profit when they are ready to sell their property. For example, if there was water damage or pest infestation from previous tenants, this should be noted on the document so buyers know about it before they close the deal.

- To make sure that no details fall through the cracks while selling your property, following these steps will ensure success: – create an inventory list with pictures – set up a timeline of what needs to be done and when – eliminate any clutter in the property – have all paperwork handy.

Who prepares the net sheet?

A reliable professional advisor should be hired to prepare a seller’s net sheet. This is because the calculations are complicated and mistakes could lead to errors in interpretation.

An experienced real estate agent knows how to calculate these numbers accurately, making it easier for both parties involved. Furthermore, an expert will take care of other tasks such as escrow services or paperwork necessary at closing time.

The seller net sheet is only one part of the equation when it comes to selling your home; there are many other factors involved such as how much money you can make on commissions from real estate sales with regard to your income tax bracket.

Real estate transactions involve out-of-pocket expenses that may not be covered by the commission: costs related to making improvements since the last sale, loan payoffs, final transfer taxes (which may be different than recording fees), and miscellaneous expenses related to the sale such as security deposits for utilities, etc.

A real estate agent has an essential role in preparing a seller’s net sheet. The process is complicated and mistakes could lead to errors in interpretation, so it is recommended that the person who does this task be experienced.

For example, if there are any costs associated with the sale that has not been calculated into these numbers, such as property taxes or loan payoff fees, etc., they should also be included on the document for accuracy purposes.

The real estate agent will also need to know the “closing costs,” which are expenses related to finalizing the transaction. Closing costs may include:

- Title company charges (typically less than one percent of the sales price).

- Transfer taxes, or recording fees (approximately 0.25%) on most transactions -Attorney’s fee ($500-$1500) for a full closing; they typically charge by the hour and usually only do closings that involve complex issues requiring legal expertise.

- Real estate commission paid to either buyer’s or seller’s agent in states where both parties have agents representing them – this is approximately five percent but can be negotiated with your professional advisor/agent as part of the total compensation package.

Real estate agents play a vital role in this process and have access to all the necessary information about mortgage payoff, property taxes, title insurance (to protect against potential lawsuits), appraisal repairs if needed.

Listing agents are typically compensated less than a buyer’s agent but they also don’t require any legal training or closing experience in order for them to get paid.

Whether you are running a real estate business or not, a real estate agent is crucial in these transactions. You may be the owner, but they have information that can help you achieve your goal in every individual situation. You can hire your own professional advisor just to make sure everything runs smoothly.oi

Transfer Taxes

Transfer taxes are a fee associated with the transfer of property from one person to another. The tax is generally collected by the seller and remitted directly to their state or local authority, who will then distribute it according to its jurisdiction’s specific needs.

Transfer taxes are typically not included in calculations for sellers’ net sheets since they are administrative costs that need only be paid once when you sell your home.

Examples of transfer taxes:

- Documentary stamp duty (sometimes referred to as “stamp duty”) which is charged on transfers between individuals -the capital gains tax chargeable on real estate transactions where profit has accrued over time

- Transfer charges such as fees levied by banks or other lending agencies incurring them during mortgage loans; could also be similar to mortgage payoff fees

- Estate taxes, which are levied on the transfer of property when a person dies.

Not all states have the same transfer taxes, so it is important to contact your real estate agent and review the seller net sheet with them. However, you can expect most states to have similar regulations, which makes it easy to find a good deal. financial picture, home warranty

Frequently Asked Questions

This is a document that summarizes the expenses and income of all property transactions on an individual’s net sheet. It can help with tax deductions, managing finances, knowing where money is going (and what you are taking in), and reducing liability because sellers know it was their own decision to sell the property.

You will be able to use this when you close your first sale. You have already calculated closing costs like title company fees ($300-$500) or recording fee($25 for every $1000).

Remember to include other miscellaneous items such as attorney fees(between $2500 -$4000) depending on the complexity of the transaction and loan payoff if your home is financed.

The seller should start calculating all fees and expenses that have been incurred up until closing time. Make sure you put them in your net sheet, including personal property taxes (property tax on your furniture or other items inside).

You will also want to keep track of any costs associated with selling your home such as agent commissions, advertising costs, etc. Sellers can use these numbers for their own financial records outside of real estate transactions if they wish; it’s just good practice so nothing gets missed out.

It is provided by the seller, and it serves as a financial record of all transactions on an individual’s net sheet.

This document summarizes the income and expenses of all property transactions on an individual’s net sheet. It can help with tax deductions, managing finances, knowing where money is going (and what you are taking in), and reducing liability because sellers know it was their own decision to sell the property. You will need this when you close your first sale.

Closing costs, property taxes (if applicable), and miscellaneous fees. You will need a seller net sheet to calculate these items when you close your first sale.

Settlement statements summarize all transactions on an individual’s bank statement while a seller’s net sheet summarizes the income and expenses of all property transactions. It can help with tax deductions, managing finances, knowing where money is going (and what you are taking in), and reducing liability because sellers know it was their own decision to sell the property.

You’ll use this document for a closing time as well as any other personal financial records outside of real estate transactions if desired by the owner/seller; it’s just good practice to know what you have coming in and going out.

Conclusion

Investors should decide on their own net sheet, depending on how they want to operate. If you are interested in buying one property at a time or several properties simultaneously, then your documents will vary accordingly.

You also need more information if you plan on staying as an absentee landlord versus actively managing the buildings that follow your portfolio. If you have any questions or comments, kindly contact us.